If you are taking a cruise you may be wondering if you need travel insurance. I have been on multiple cruises and always purchase travel insurance for the reasons mentioned in this post.

If you’re looking for quick recommendations, these are the websites explained in detail in this post (these are comparison websites so will show you multiple quotes):

US Recommendation:

Aardy – (Both Pre Existing and No Pre Existing Conditions)

UK Recommendations:

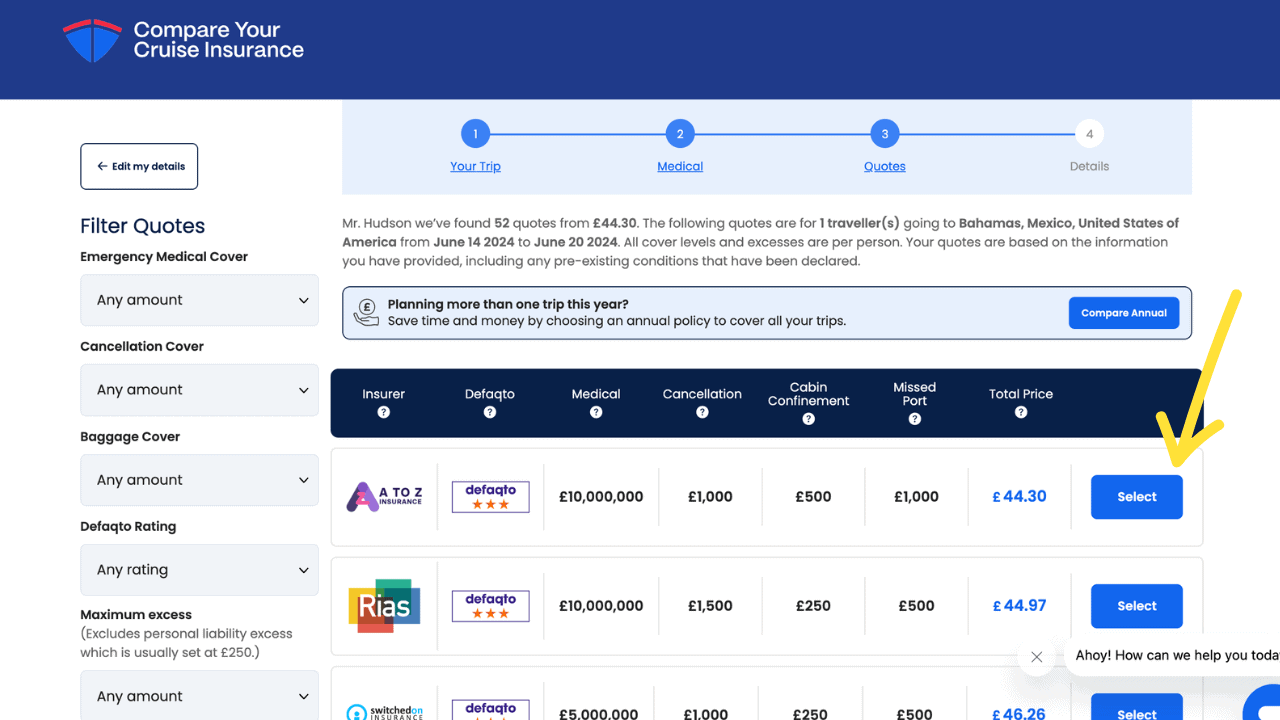

Compare Your Cruise Insurance – (Both Pre Existing and No Pre Existing Conditions)

In this post we will look at:

- Why you need travel insurance for a cruise

- What you need to be included in your travel insurance policy

- How to find and book a policy to suit your budget and needs – step by step guides to buying insurance in the USA and UK with pre existing health conditions (and no conditions).

Do You Need Travel Insurance For a Cruise?

All guests taking a cruise need to purchase a travel insurance policy before taking the cruise. Many cruise lines will not allow guests to embark without a valid policy. Travel insurance is a cruise requirement regardless of nationality, cruise location or any other factor.

Travel insurance policies vary dramatically in price and inclusions, it’s important to find the right policy to suit your needs and budget.

Why do You Need Travel Insurance for a Cruise?

If you are considering a cruise close to home, for example, you are from the US and taking a cruise to the Caribbean or from the UK and taking a cruise around Britain you may be wondering why travel insurance is necessary.

The main reason why you need travel insurance for a cruise is because of the high costs of medical care on cruise ships and the risk of needing to be transported to land. If an accident did happen at sea the medical expenses can be astronomical.

If a cruise ship has to be diverted or a helicopter used to take a guest to land this can easily reach hundreds of thousands of pounds. If a guest didn’t have travel insurance they would be liable for this amount and the expenses could easily bankrupt a family.

If you are from a country that has a national health service, or if you have a health insurance policy in a country like the USA this is usually not valid when on the ship. There may be a few exceptions, but generally speaking, you will not be covered.

What Happens if You Don’t Have Travel Insurance For a Cruise?

If you take a cruise without having travel insurance you risk losing your cruise fare, paying huge medical expenses, being unable to return to your home country, and much more.

In some situations, it could be argued that if the person in question had travel insurance they may not have died when they did. One such situation is the case of Bruce who suffered a heart attack on a Carnival cruise in 2019 and died when he was unable to get back to the United States.

To learn about Bruce’s story and that of other passengers who didn’t have travel insurance or had incorrect travel insurance, check out this post:

What does Cruise Travel Insurance Cover?

Cruise travel insurance covers medical expenses, repatriation, and costs incurred from cancellations. Cruise travel insurance can include cabin confinement and missed port cover if purchased at an additional cost.

Some of the most important inclusions are as follows:

Cancellations

The majority of travel insurance policies cover cancellations. If your cruise was cancelled by the cruise line they would refund your fare but other things such as travel costs, hotels, car parking, etc would not be covered. Travel insurance would allow you to claim refunds on expenses such as these.

This is particularly important since the coronavirus outbreak as cruise cancellations happen more often.

Lost or Damaged Luggage

If your luggage is damaged on the ship or during your journey many travel insurance policies will cover replacement items or will refund you the costs.

This cover may also help you if your passport was lost and you incurred costs because of this.

Cabin Confinement

Many travel insurance policies will include what is called ‘cabin confinement’ cover. This means that guests would receive a set amount of money per day if they were confined to their cabins due to illness.

This illness would need to be recognized by the onboard medical center and is designed to make up for any loss of enjoyment.

I’m sure the majority of people would prefer to be out enjoying their cruise but this can be a welcome surprise for guests who do fall sick when cruising.

Port Cancellation

Port cancellation cover is usually an add-on to cover that comes at an extra cost. If you have port cancellation cover in a policy and for any reason, a scheduled port stop is canceled you may be able to claim a fixed amount per port.

It is never nice to have a port canceled but unfortunately, this is a very common occurrence. I would say around a quarter of the cruises that I have been on have had some sort of itinerary change or cancellation.

Common reasons for itinerary changes/cancellations include:

- Weather (bad weather may cause a cruise ship to skip a port or substitute another)

- Political Unrest

- Ports Full (believe it or not this does happen)

To learn more about how to claim for a port cancellation, check out this post: Do You Get Compensation For Missed Cruise Ports?

Medical Expenses

All travel insurance policies will include medical expenses. Each policy usually has a maximum amount that it will cover in regards to medical expenses but this is often into the millions of pounds.

Your medical expenses will be paid by your travel insurance but in some situations, the guest may be required to pay the expenses and then claim them back after the cruise.

This tends to happen in the case of minor injuries with major injury claims being sorted with the travel insurer directly.

Cruise ships do have medical centers and doctors on board. To learn more about where you can buy medicine on cruises, and how much you can expect to pay, check out this post: Cruise Ships Don’t Have Full Pharmacies on Board – Here’s What They Have.

What Are The Main Types of Cruise Travel Insurance?

Annual Policies

For guests that cruise frequently, an annual policy is usually a good option. This is what I usually go for as I travel multiple times per year.

It’s important to remember that if you do select this policy you will need to select the countries that you will visit on ALL cruises when purchasing.

I would recommend purchasing worldwide cover with no exclusions as you may not know in advance where you plan to travel to. If you purchased an annual policy for Europe then booked a trip to Australia, you would not be covered.

One-Trip Policies

For guests who only travel once or twice a year a one-trip policy is usually the best option.

When buying a one-trip policy you will be asked to fill in your travel dates, some information about yourself, and which countries you will be visiting.

This is the most common form of travel insurance.

Things to Remember When Buying Cruise Travel Insurance

Always Purchase ‘Cruise Cover’

The most important thing that you need to remember is to buy a policy that includes cruise cover. This is often an add-on or a box that you need to tick when purchasing travel insurance. Without this addition, you would not be covered for any expenses during the trip.

Many websites will ask you if you need cruise cover at the start of the quoting process. Do not forget this step!

The above is explained in more detail in the instructions later in this post.

Declare Existing Medical Conditions

The most common reason why insurance requests are denied is because of undeclared medical expenses. All illnesses, ongoing tests, and past conditions must be declared.

It is MUCH better to mention more than less, if you are unsure whether a medication or medical issue is worth mentioning, do it.

It isn’t uncommon for travel insurance policies to have a list of ‘allowed’ medical problems that don’t have to be declared such as high blood pressure. This will vary by company.

Examples of passengers who didn’t correctly disclose medical conditions (and as a result invalidated their insurance) can be found on this post: 5 Cruise Nightmares Caused by Not Having The Correct Travel Insurance (Real-Life Examples)

When Should You Buy Travel Insurance For a Cruise?

Travel insurance for a cruise should be bought as soon as the cruise is booked. The travel insurance comes into effect as soon as it is purchased. This means that if the cruise was canceled it would be covered by travel insurance.

The price of travel insurance doesn’t get cheaper closer to the sailing date so there really is no reason to put of purchasing insurance.

How to Buy Travel Insurance For a Cruise

When purchasing travel insurance I always recommend using a price comparison website. This allows you to type in your details once but you get multiple quotes from different companies.

Without using a comparison website you would have to type in your details to multiple websites to compare quotes. This would be time-consuming and I doubt that anybody would try as many sites as a comparison site can do instantly.

US Recommendation:

Aardy – (Both Pre Existing and No Pre Existing Conditions)

UK Recommendations:

Compare Your Cruise Insurance – (Both Pre Existing and No Pre Existing Conditions)

Using the websites above you are also able to save your quotes so you can come back later or repurchase cover at a later date. It’s completely free to use and only takes a couple of minutes.

How to Get Travel Insurance (US) – Step by Step Guide (Both Pre Existing and No Pre Existing Conditions)

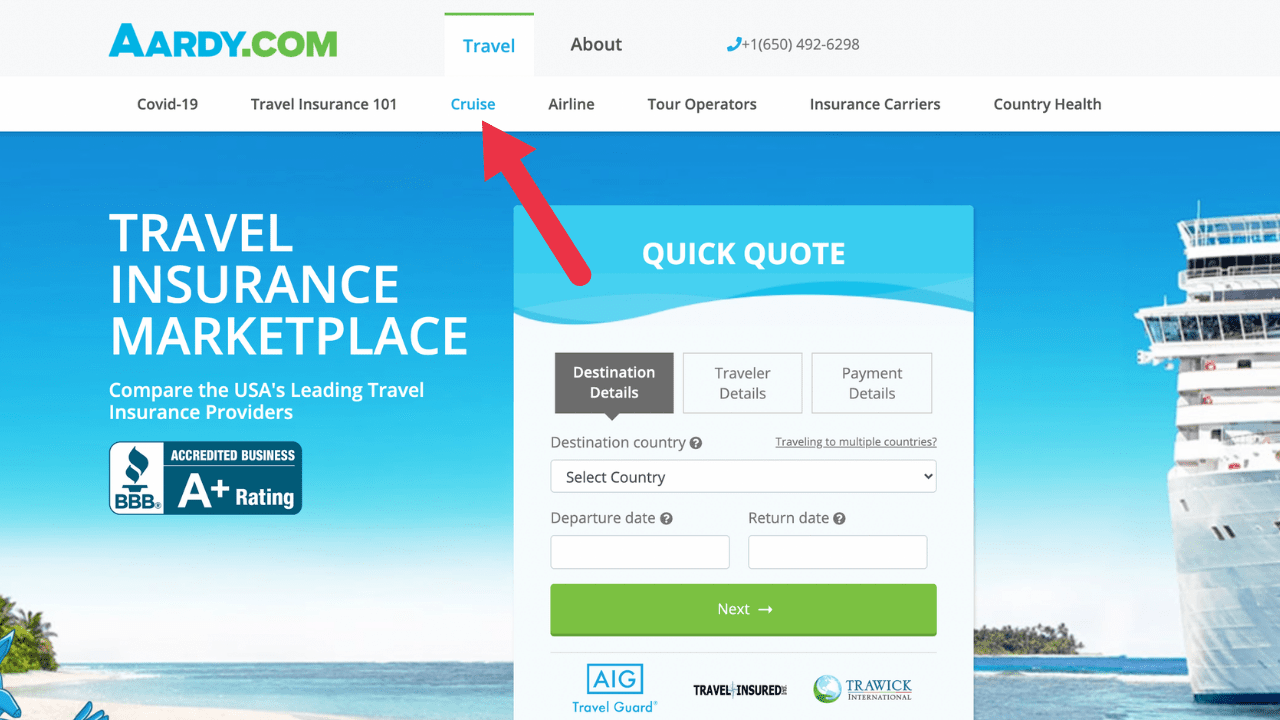

Step 1 – Get a New Quote

To start click here and then click ‘cruise’.

Step 2 – Get a New QuickQuote

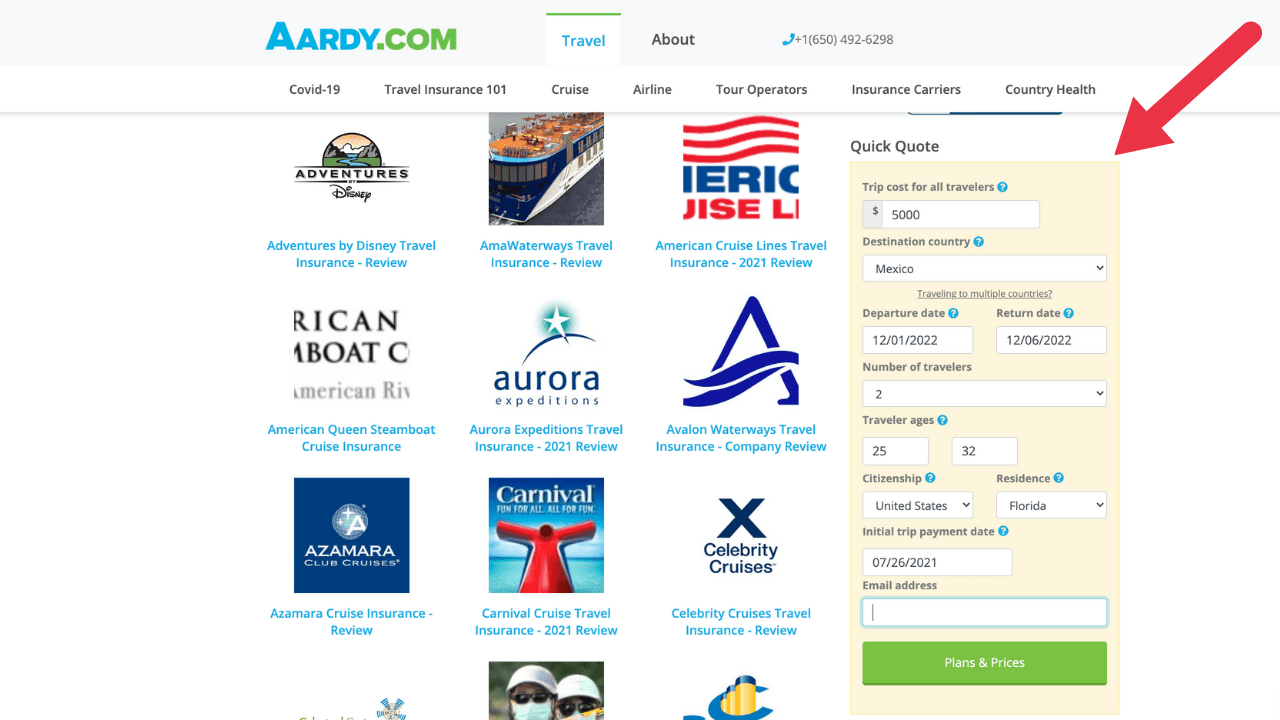

Enter the details of your trip into this box on the right then hit ‘Plans and Prices’. The good thing about using comparison sites is that when you have entered your details the website will compare different providers without you having to retype your details.

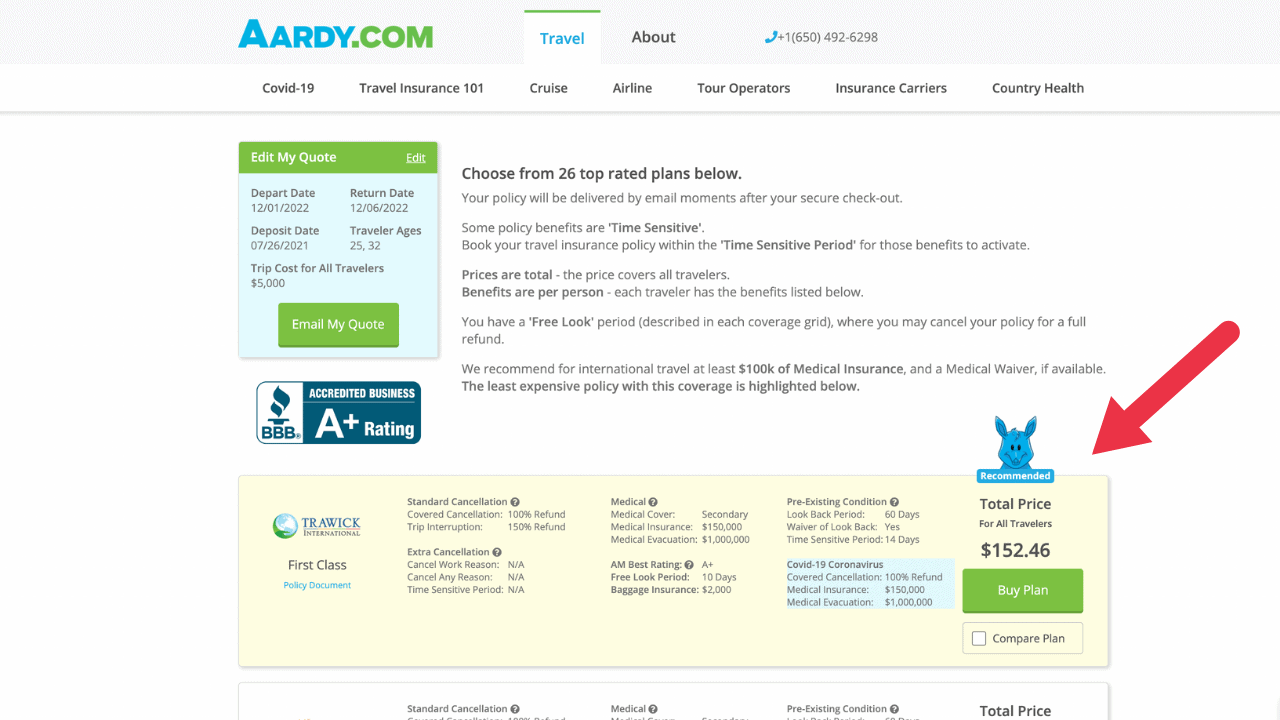

Step 3 – View Plans

The website will provide you a list of policies that you can purchase. If you’d like these to be emailed to you hit the ’email my quote’ button. Aardy recommends a plan based on reviews and coverage.

In this case, we have 26 policies to choose from.

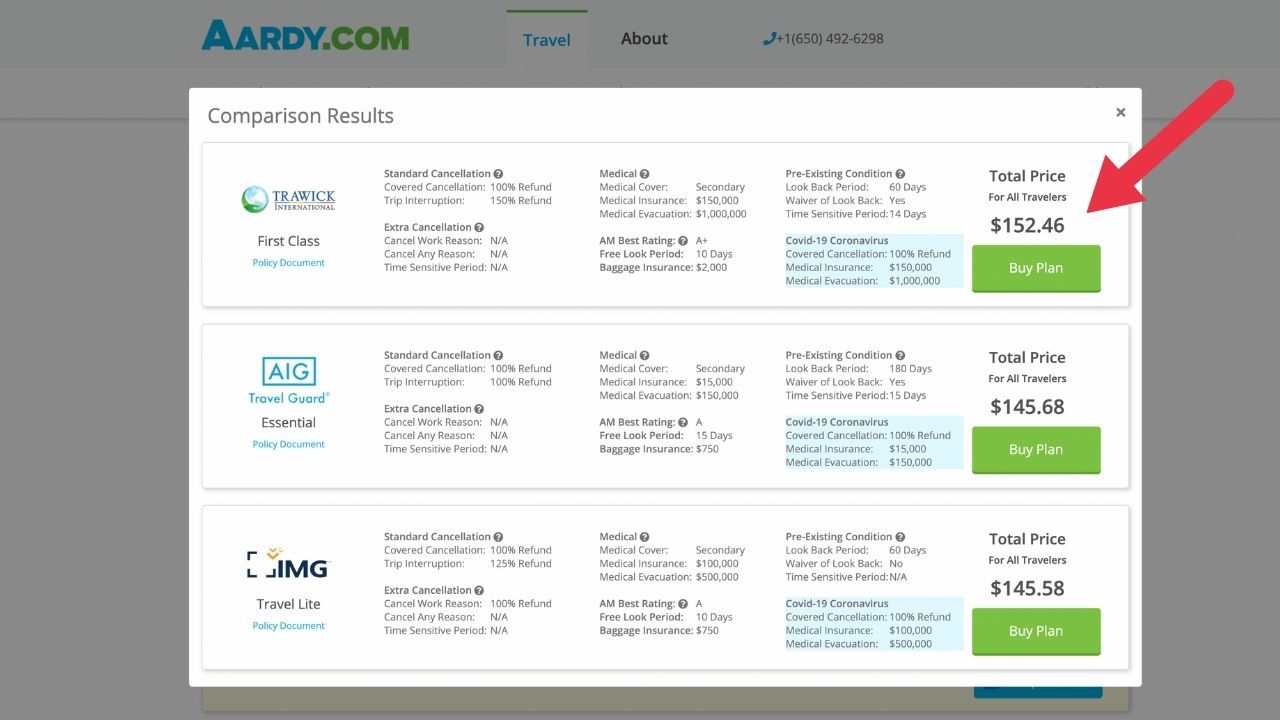

Step 4 – Compare Plans

By selecting multiple plans the website will show these side by side for you to compare. This makes it easier to look at the differences, for example the first policy is the most expensive but has a LOT more medical insurance cover than the rest.

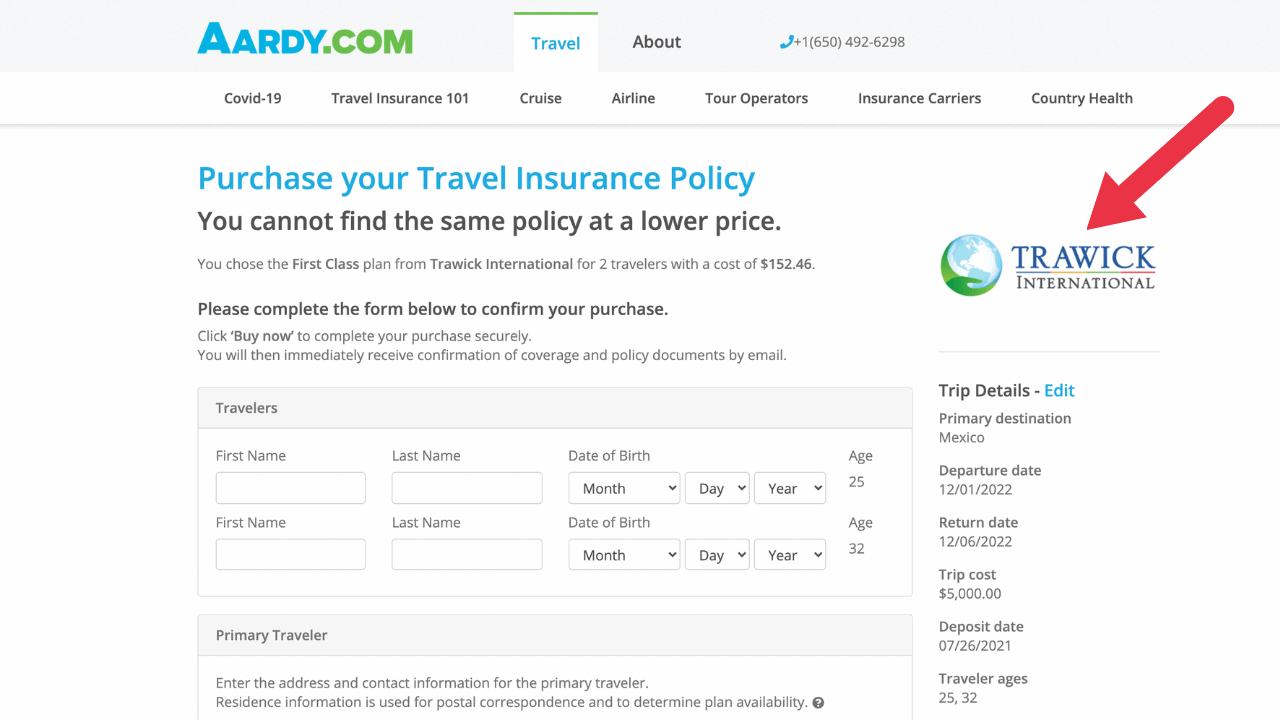

Step 5 – Purchase a Plan

When you’ve decided on a plan the Aardy website will ask you for more information. You’ll be able to see which company the policy is through on the right.

Note: If you’re from the US and use another website to purchase your travel insurance make sure you are purchasing cruise-specific cover by clicking the ‘cruise cover’ button. On the Aardy website, because you are specifically filling in your details for a cruise quote, there is no box to tick.

If you have a pre-existing medical condition there is another step that you need to look at when purchasing a policy from Aardy.

Pre Existing Medical Problems

If you have any pre-existing medical problems these need to be disclosed to the travel insurance company. Generally speaking, pre-existing medical problems are defined as (US definition, the UK and other countries tend to look further back):

- A condition that you’ve recieved a recommendation for a test, examination or medical treatment for within the last 60/90 days.

- A condition that you’ve taken a prescription medicine for within the last 60/90 days.

Some travel insurers have a longer ‘look back’ period which means they will look at how medical conditions have changed or developed in a period longer than 60 days.

If you have had a serious health problem like cancer, even if this was years ago, you’ll probably still need to declare it.

There are many medical problems that don’t need to be disclosed when purchasing cruise travel insurance, below are a few examples:

Acne, Many allergies, Bell’s Palsy, Bunions, Cataracts, Gastric Reflux.

When purchasing a travel insurance policy that requires a pre-existing medical condition to be disclosed the travel insurer will usually provide an ‘exclusion waver’. This basically means that they won’t cover any medical costs associated with this problem.

How to Get Cruise Travel Insurance in the US For Pre Existing Medical Conditions – Step by Step Guide

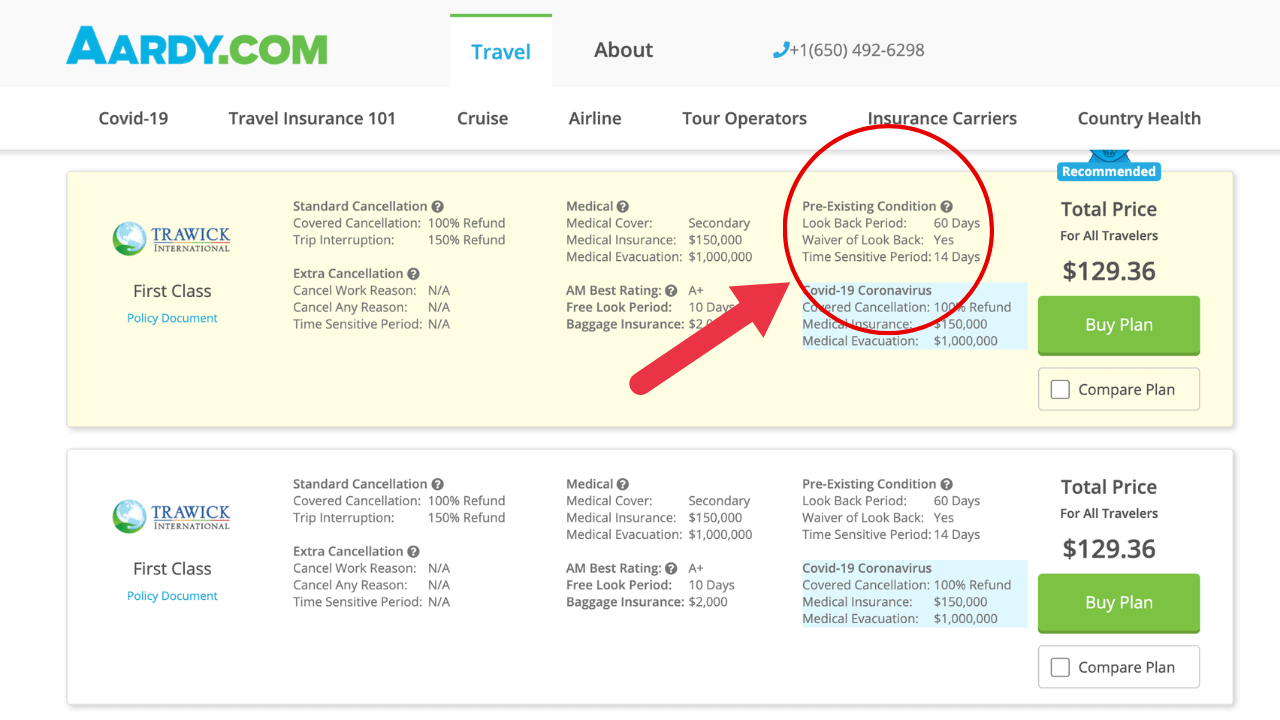

Step 6 – Extra Step for Pre Existing Medical Conditions

If you are from the US and have pre-existing medical conditions follow the steps above until you have quotes displayed.

Purchasing a travel insurance policy for pre-existing medical conditions is different in the US from most other countries. In most other countries, like the UK and Australia, specific medical conditions have to be disclosed before purchasing the policy.

In the US this isn’t the case. Thanks to Brandon at Aardy who helped me to understand this one.

If you have a pre-existing medical condition you want to look for a policy that has a look back waiver.

The lookback period, as mentioned above is the time in which the company will look back at any medical problems you may have. The waiver effectively means that the policy will not look back at your medical history and as long as you are medically fit to travel, you will be covered for all pre-existing medical conditions.

Be aware though, this is only the case if you book the policy within the time-sensitive period, which is how long after booking the trip you book the insurance.

“If they purchase within the Time Sensitive Period, they would be covered as long as they are medically fit for travel at the time the insurance is purchased. If they miss the 10-21 day window, we do have a couple of policies that offer pre-existing condition coverage if they purchase on or before their final trip payment date. Those policies are the IMG Travel LX and the Trawick Voyager.

brandon – Aardy

If you are in doubt, speak to the nice people at Aardy. They have a live chatbox where they will answer any questions and you can phone them too.

How to Get Travel Insurance (UK) Pre Existing and No Pre Existing Conditions – Step by Step Guide

Step 1 – Get a New Quote

To start click here and then click ‘get a quote’.

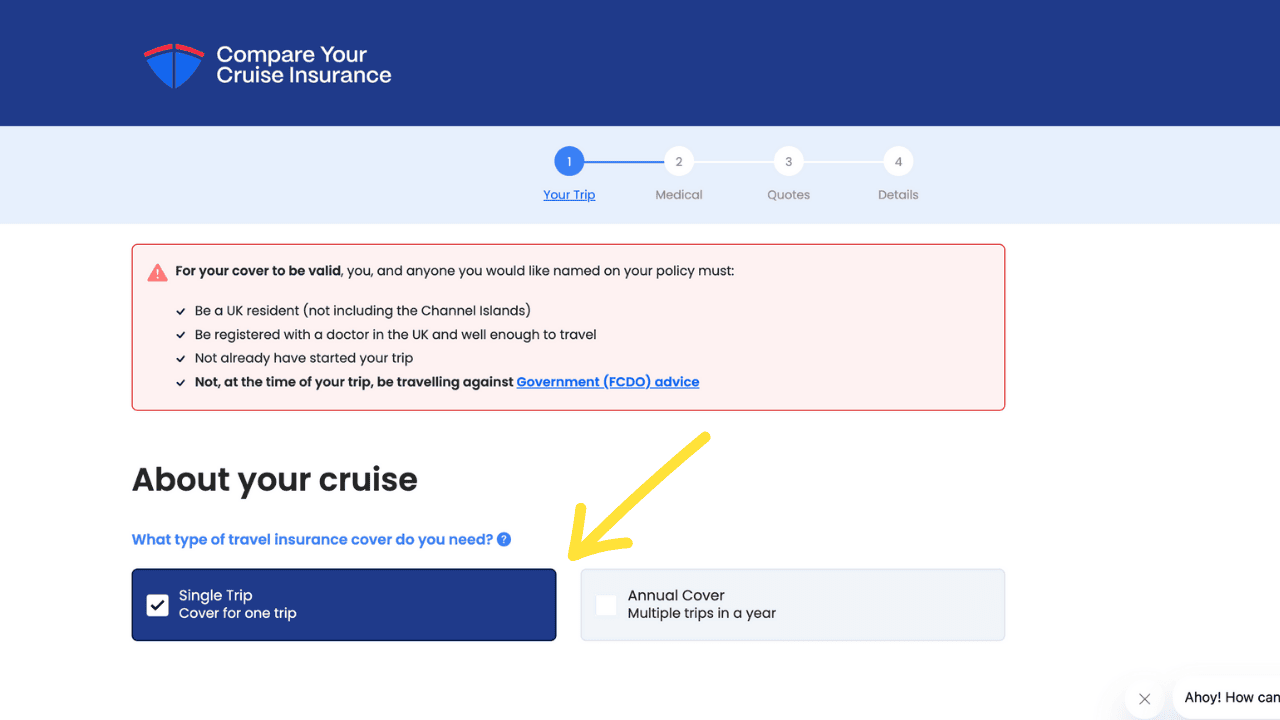

Step 2 – Decide on a Cover Type

After clicking get a new quote you’ll be sent to a page where you have to decide if you would like an annual policy or a one-trip policy.

For the purposes of this, I will be selecting a one-trip policy but if you do think you’ll be traveling multiple times per year, it may be worth doing an annual quote.

You can always do both quotes.

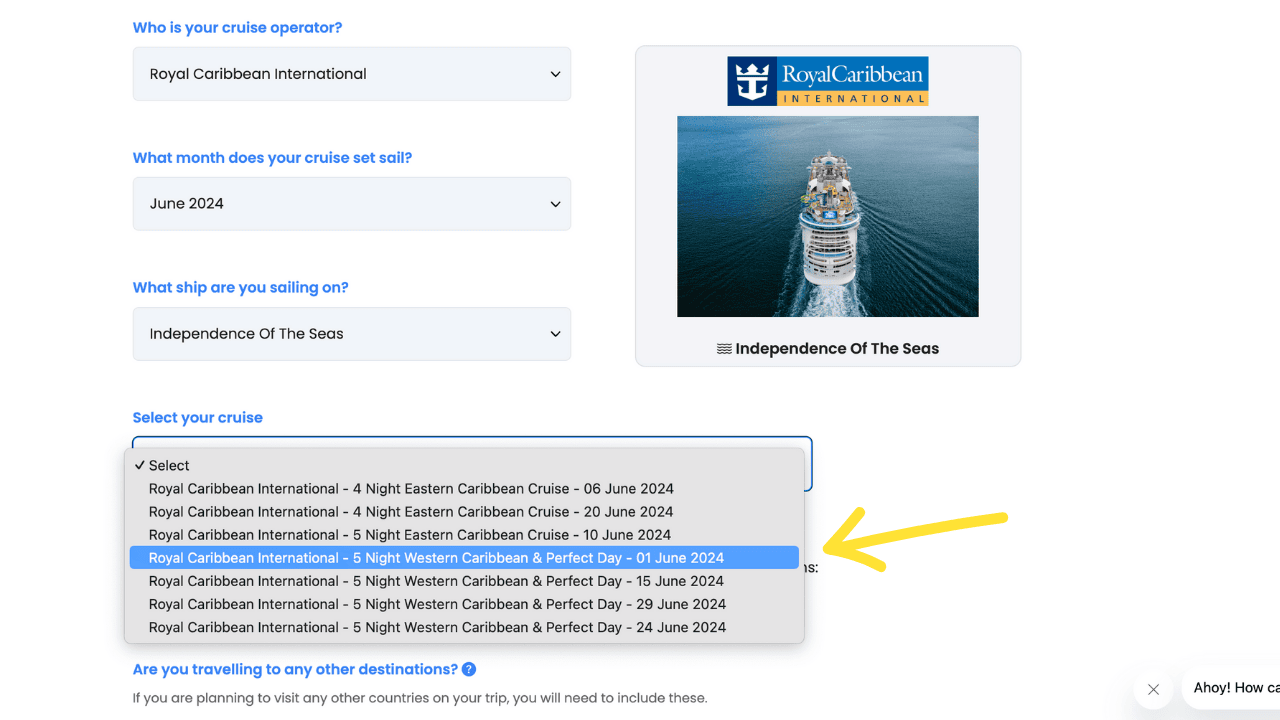

Step 3 – Enter Your Cruise Details

The next thing that you’ll be asked is for details of your cruise. Enter your cruise line and cruise ship.

Pick your cruise from the list and the website will automatically work out which countries you are going to. Magic!

Because it asks you about your cruise line it’ll make sure you have enough cover in all of the policies that come up.

Note: You can add extra destinations if you are also doing some travelling not on the cruise.

If you are planning on having a few days on land pre or post cruise you can add those by adding the dates below.

I often fly out and spend a couple of days in a port pre-cruise, so this would cover that.

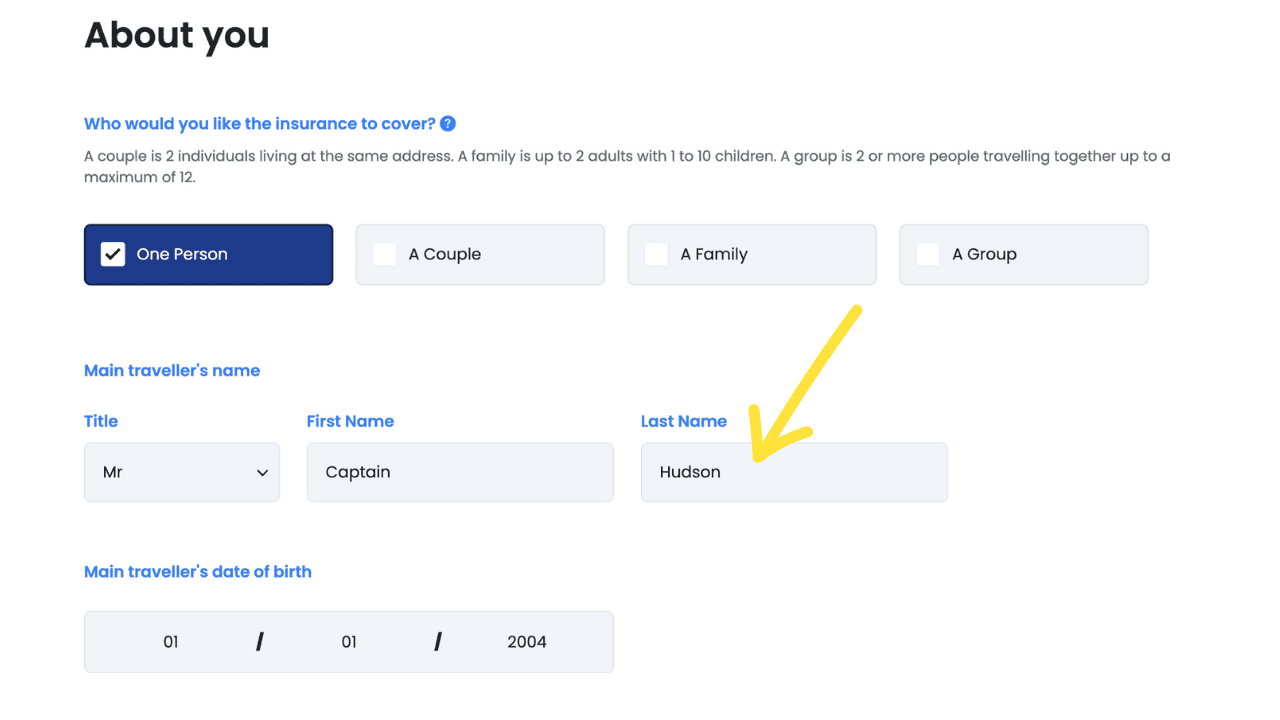

Step 4 – Enter Your Details

After entering details about your trip you’ll be asked for details about yourself. This includes:

- How many people are travelling

- What are their dates of birth

- What are their names

- Do any of the people on the policy have any pre-existing medical conditions

After this, you’ll be asked to enter your email address and then you’ll receive quotes from multiple companies.

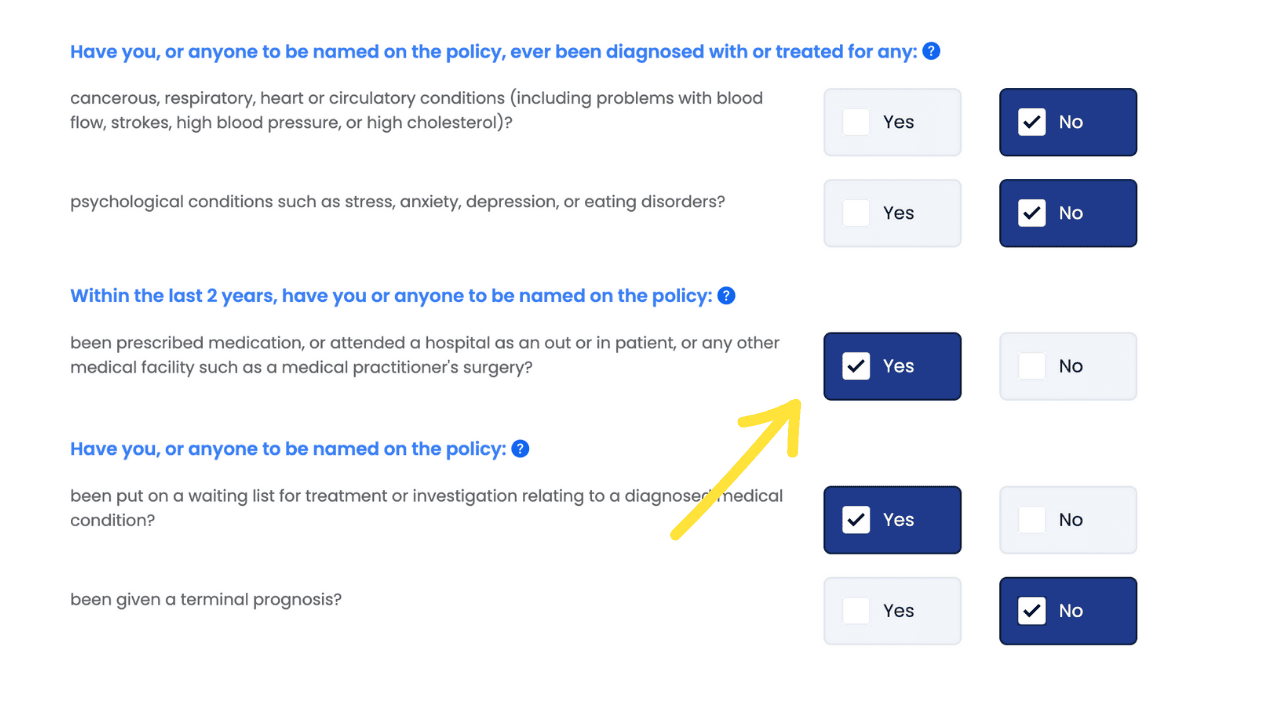

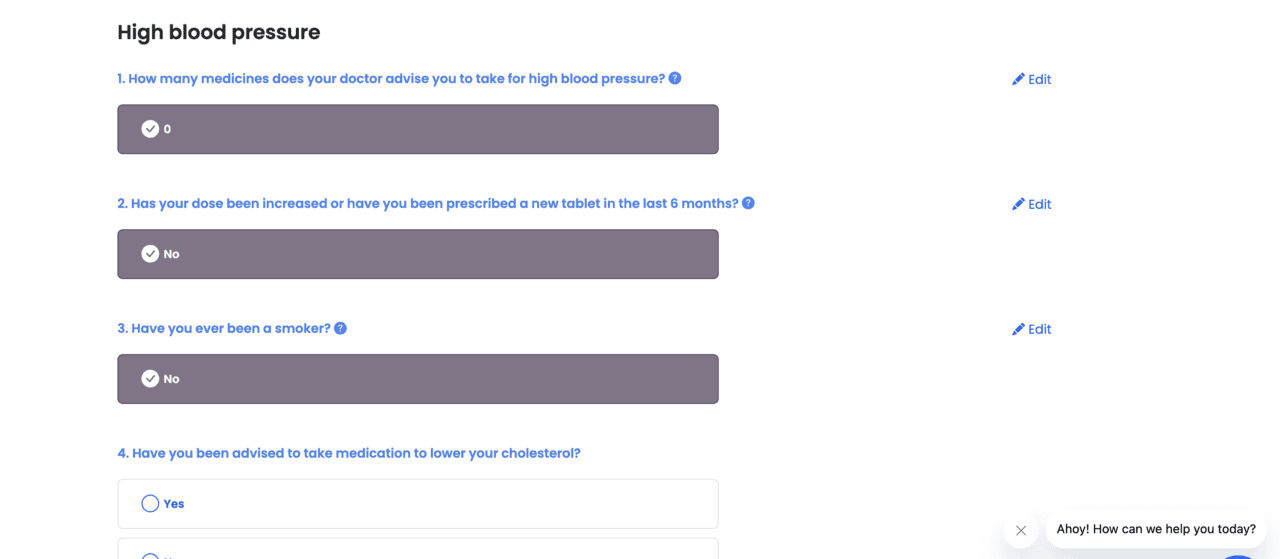

How to Get Travel Insurance (UK) With Pre Existing Medical Conditions – EXTRA STEP

Step 5 – Only Required For Pre-Existing Medical Conditions

Tick the boxes which relate to your medical situation.

There are lots of medical issues that don’t require anymore information and don’t actually increase your quote price but it’s always better to add things than to not.

Depending on the condition, there will be different questions to answer. When you are done press ‘ADD’. You can add as many as you need to.

Step 6 – Compare Quotes and Purchase

The website will compare the quotes and show you policies that fit your needs.

Every policy will have enough medical cover as required by the cruise line that you are travelling with.

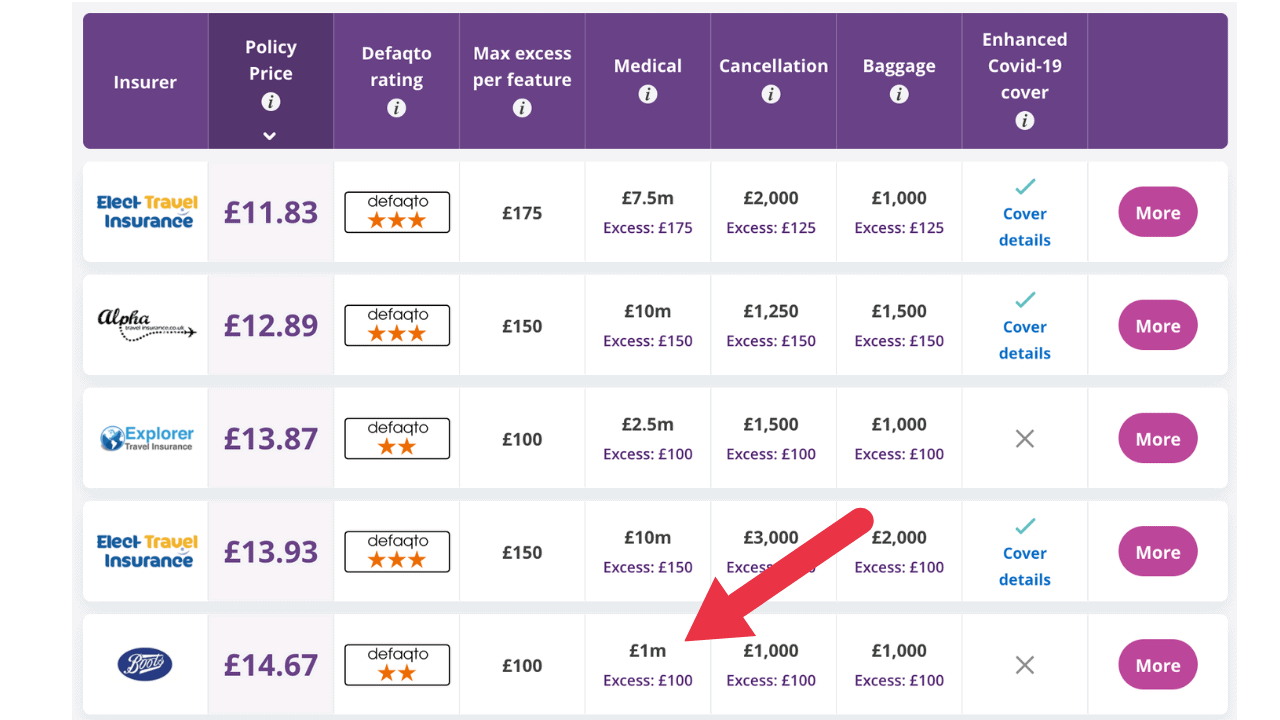

What to Look Out For in Travel Insurance Quotes

Make Sure The Policy Matches the Minimum Requirements of The Cruise Line

If you have used Compare Your Cruise Insurance as shown above, this won’t be a problem, but if you are looking at policies outside of the website, you should be aware of this.

Many cruise lines will have their own minimum travel insurance requirements. For example, P&O cruises currently require cover of at least 2 million for medical expenses and repatriation.

When booking a cruise the cruise line will inform you of this.

The majority of the quotes provided to me, shown below, did include the 2 million pounds medical cover needed for a P&O cruise however one policy provided by boots only had 1 million pounds worth of medical cover.

This is below P&O’s mandatory minimum and as a result, you would not be allowed to board the cruise with this cover.

P&O have said that they will be checking travel insurance at the terminal so it’s important to make sure that you meet the cruise lines requirements.

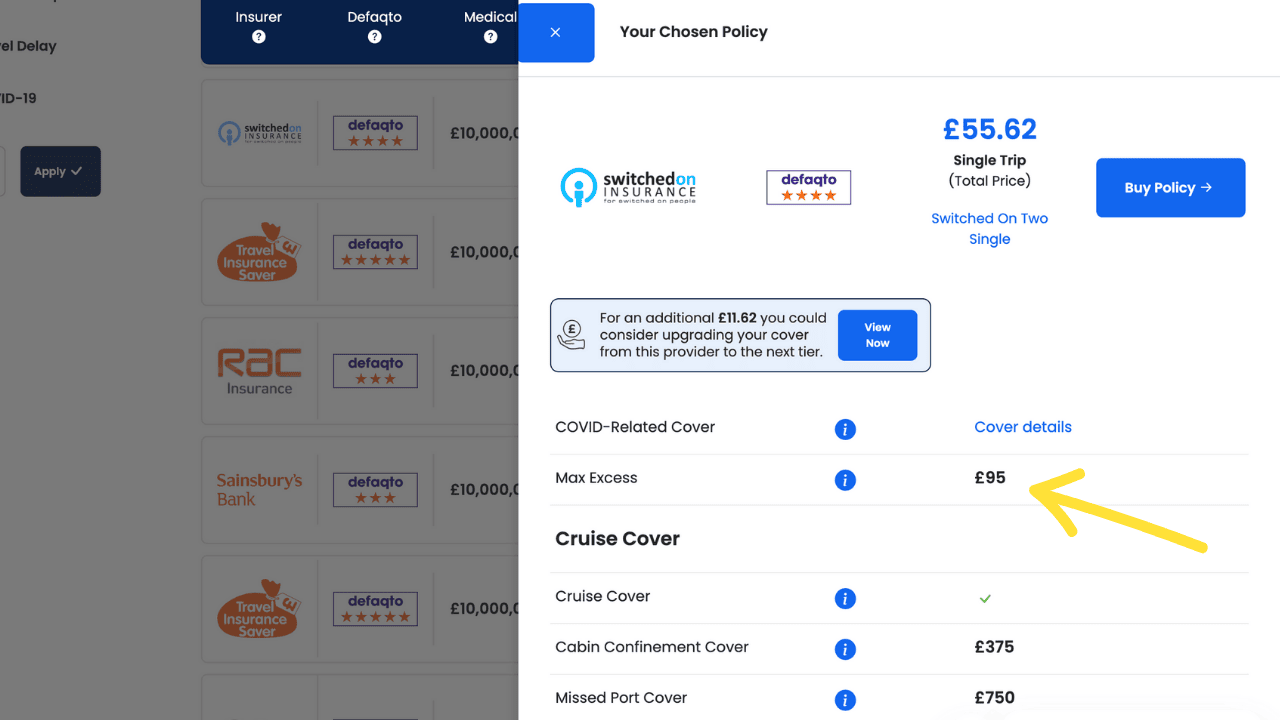

Make Sure You’re Happy With The Excess Amounts

All travel insurance policies will have an excess amount attached to the policy. This is the amount that you have to pay before the insurance will kick in and pay the rest. Travel insurance policies with lower excesses usually cost a little more.

These three policies below have a £50 excess compared to the cheaper policies with a higher excess.

Check the Defaqto Rating

The Defaqto rating is a rating that provides a review of the quality of a product on a 1-5 star basis.

When choosing a travel insurance policy I usually look for the cheapest policy that has a 4* defacto rating, meets all the cruise lines minimum requirements, and has an excess that I am happy with.

Purchasing Travel Insurance from The Cruise Line or a Travel Agent

The majority of cruise lines and travel agents will be able to offer travel insurance directly. They usually partner with one company and are able to quote on this basis.

Although this is often a very easy way to get travel insurance it can be considerably more expensive than doing a comparison. The benefit of booking through a cruise line however is that you know that the cover you’ve chosen meets all of the requirements requested by the cruise line.

When booking a cruise you’ll usually be asked by the cruise line if you’d like to add travel insurance at the point of booking.

My personal preference is to use a comparison website as mentioned above because this gives me control and allows me to find a policy that fits both my needs AND my budget. I usually buy an annual policy and this is easy through a comparison website.

It Happened on my British Isles Cruise

A couple of years ago I took a British Isles cruise with Princess, which was absolutely amazing. During the cruise a man on the ship became unwell and the ship had to divert in order to disembark him.

A helicopter was not used but an emergency boat came to collect him from the cruise ship to avoid the cruise ship having to be docked. I’m not sure about the exact cost but I can imagine that it was not cheap.

When you think about the cost of the diversion, the extra boat, and the people involved in getting him to safety, it could have been very expensive. I hope that he had travel insurance (and was okay)!

In Summary

If you are taking a cruise, you NEED travel insurance. The costs of medical care and repatriation should an accident occur could be huge.

Asides from this there are a number of other benefits provided by travel insurance such as cancellation cover.

US Recommendation:

Aardy – (Both Pre Existing and No Pre Existing Conditions)

UK Recommendations:

Compare Your Cruise Insurance – (Both Pre Existing and No Pre Existing Conditions)

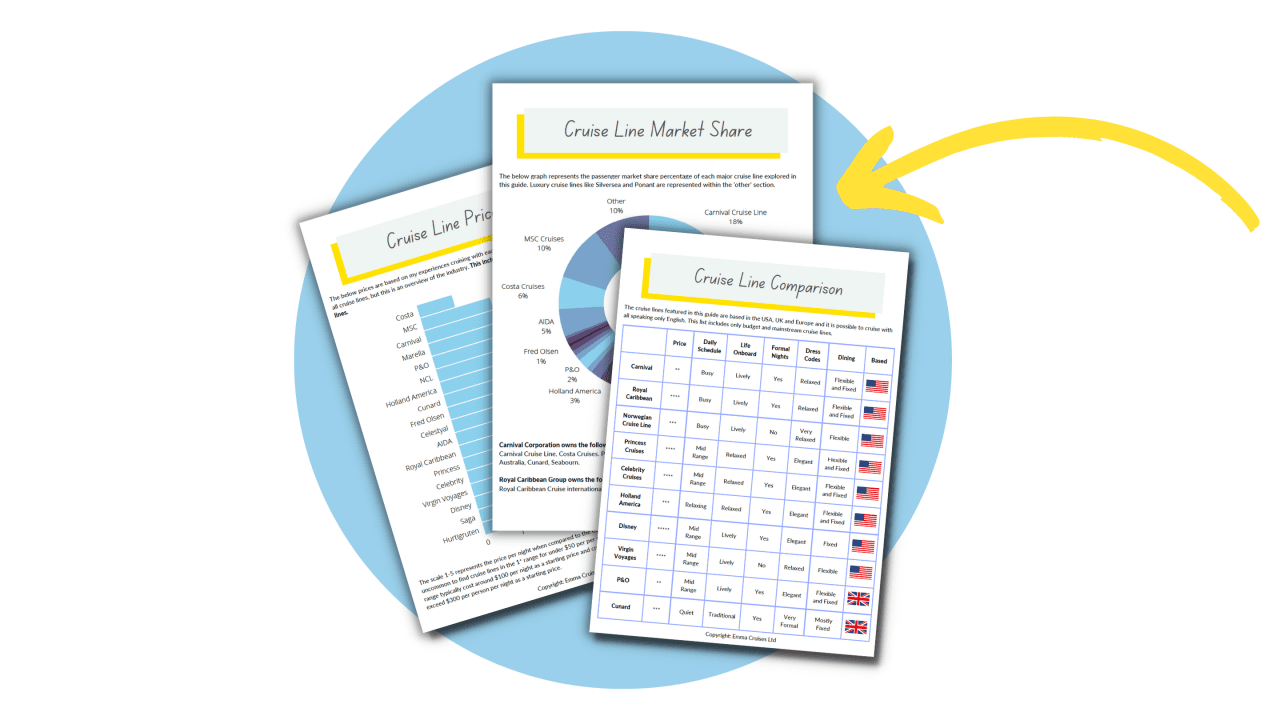

Free Insiders Cruise Line Guide

Ever wondered how the mainstream cruise lines compare? Cruise lines won’t tell you this, but I will.

This FREE guide shows you everything you need to know to find your perfect cruise line.

Whenever I take a cruise I order a print of my trip. It uses the real satellite data from the cruise and is always a great conversation starter!

I'm building an impressive collection...

Code EMMACRUISES will get you 10% off