This post may contain affiliate links, which means that I may earn a commission if you make a purchase at no additional cost to you.

If you are planning to book a cruise, you will need to think about buying travel insurance to cover the trip. If you don’t do this, you may end up losing your money if you need to cancel – or worse still – end up with a huge bill should something go wrong!

Some cruise lines offer to sell you travel insurance when you book the cruise. This makes everything very easy, but is that the best option?

In this article, we look at the advantages and disadvantages of taking out cruise line insurance policies. I have taken out cruise lines policies in the past and bought independently.

If you’re looking for quick recommendations, these comparison websites so will show you multiple quotes which you can compare to the cruise lines:

US Recommendation:

Aardy – (Both Pre Existing and No Pre Existing Conditions)

UK Recommendations:

MoneySupermarket – (No Pre Existing Conditions)

AllClear (Pre Existing Medical Conditions)

Why is it Important to Take Out Cruise Travel Insurance?

Taking out Cruise Travel Insurance can potentially protect you from huge costs, should something go wrong both before or during your cruise. Insurance will often cover:

- Cancellation prior to cruising

- Emergency treatment whilst on holiday – including anything Covid related

- Medical evacuation from your cruise ship

- Lost possessions and baggage

- Missed port cover

To learn more about what could happen if you cruise without cruise-specific travel insurance, check out this post: 5 Cruise Nightmares Caused by Not Having The Correct Travel Insurance (Real-Life Examples)

When Should You Take Out Cruise Travel Insurance?

You should take out cruise travel insurance as soon as possible after booking.

You may need to cancel your cruise unexpectedly and if you do, you should be able to claim your money back, even if it’s close to the sailing date.

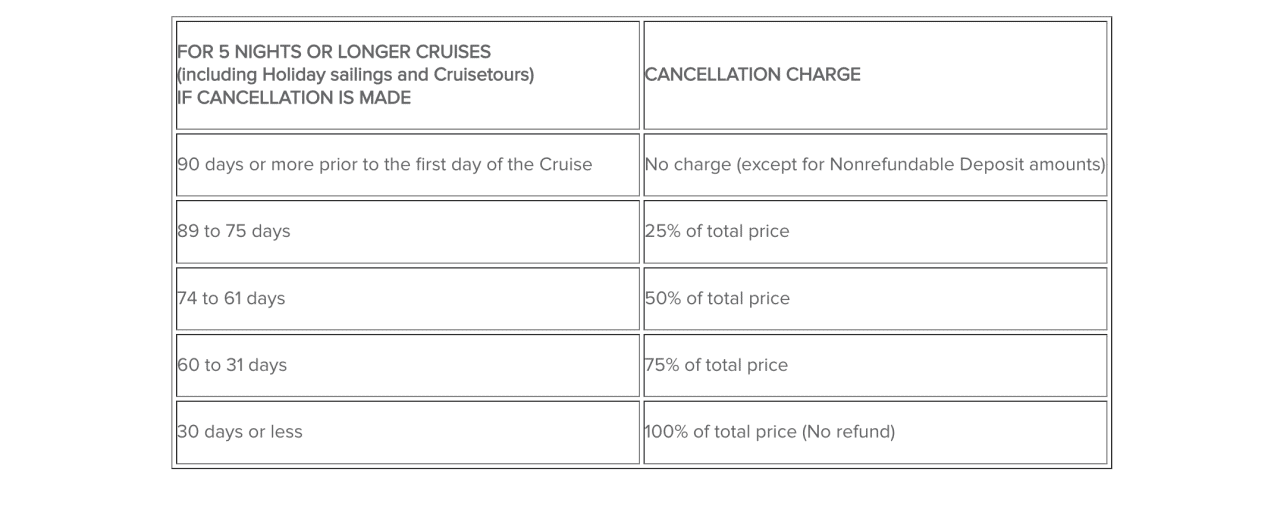

Cruise companies’ Terms and Conditions often say that you may receive a percentage of your cruise fare back should you cancel – but it is on a sliding scale. The closer to the date of the sailing you cancel, the less of a refund you receive.

Often if you cancel within 30 days you will receive no refund at all. That can be a lot of money to lose!

If you cruise more than a couple of times a year, it may be worth looking into taking out an annual policy. This often works out far cheaper than taking out a single policy every time you cruise

Does Travel Insurance have to be Cruise Specific?

Your travel insurance must be cruise specific!

Make sure any insurance cover you take out specifically covers you for cruises, if you don’t you may find you aren’t covered when you come to claim.

Many people have travel insurance policies that come as a perk of a paid-for bank account. If this applies to you, make sure it covers you for cruising – many policies don’t!

You may be able to add an additional Cruise Cover to that policy for an extra charge.

The last thing you want is to think you are covered – then find out when you come to claim that you are not.

The cost of being airlifted from a cruise ship with a medical emergency can be huge.

Which Cruise Lines Offer Travel Insurance?

All mainstream cruise lines offer to sell you travel insurance. In some cases it is just a case of putting a tick in a box to say you want it, in other cases, they direct you to a page on their website suggesting where you should buy it.

All of these “partner” companies are underwritten by established insurance companies. Basically, cruise companies are making a commission by sending your business their way.

It is worth noting that in the United Kingdom, the mainstream cruise lines all direct you to their partner agents – Holiday Extras.

It is relatively easy to compare their quote to others being offered directly by other insurance Companies.

In the United States, cruise lines partner with various different insurance companies.

| Cruiseline | Company/Underwriters |

|---|---|

| P&O | Great Lakes Insurance SE (Via Holiday Extras) |

| Cunard | Great Lakes Insurance SE (Via Holiday Extras) |

| NCL (UK) | Great Lakes Insurance SE (Via Holiday Extras) |

| NCL (USA) | Transamerica Casualty Insurance Company |

| Celebrity (UK) | Arch Insurance Company |

| Royal Caribbean (UK) | Great Lakes Insurance SE (Via Holiday Extras) |

| Royal Caribbean (USA) | Arch Insurance Company |

| Costa | Nationwide Mutual Insurance |

| Princess (UK) | Great Lakes Insurance SE (Via Holiday Extras) |

| Princess (USA) | Generali U.S. Branch, New York, NY |

| MSC | Generali Group Via Europ Assist |

| Carnival (UK) | Nationwide Mutual Insurance |

| Carnival (USA) | Great Lakes Insurance SE (Via Holiday Extras) |

| Holland America | Nationwide Mutual Insurance Company |

| Marella | AXA |

Why Do Cruise Lines Offer Travel Insurance?

Cruise lines will offer you travel insurance for two reasons:

- They make money by selling it to you

- They want you to have adequate insurance in case of all eventualities!

Will Your Claim be Settled More Quickly if you Buy Cruiselines Insurance?

Your claim will not necessarily be settled more quickly and easily if you take out the cruise line’s travel insurance.

I know of one poor traveller who had a medical emergency onboard on a cruise.

Once he left the sick bay, he was constantly badgered for payment by the cruise line.

“I was out of the sickbay by Friday and for the next three days there were notes on my door, my bed, and constant phone messages asking for payment.”

He emailed his broker and got him to transfer the $8,000 he owed for medical treatment and two days of stay in the sick bay. Months later, he still hadn’t had the travel insurance money back!

“The topper is that I HAD TRAVEL INSURANCE – FROM THE CRUISE LINE!“

I think the moral of this story is don’t expect travel insurance taken out via the cruise line to be quicker or better.

Do make sure you have extra money available, as cruise companies won’t necessarily be happy to wait for the travel insurance to pay out!

You may have to pay your medical expenses and other costs upfront, then claim it back through your Travel Insurance

What Are The Benefits Of Booking Directly With The Cruise Line?

If the cruise line you are travelling with offer insurance, taking this out is a straightforward and simple option. You can be sure it is cruise specific and should cover all your needs.

Is it Better to Book Your Own Travel Insurance Directly?

It is usually cheaper to research and book your own cruise travel insurance policy.

You can compare a number of companies for price and coverage offered then see which one suits your needs best.

The below are my favourite websites to use to compare insurance companies:

US Recommendation:

Aardy – (Both Pre Existing and No Pre Existing Conditions)

UK Recommendations:

MoneySupermarket – (No Pre Existing Conditions)

AllClear (Pre Existing Medical Conditions)

It is vital to make sure that the insurance suits your needs. If you are prepared to take the time and do some research, there are great savings to be made!

Make sure you declare any pre-existing medical conditions or medications you take. If you don’t do this, the travel insurance may not pay out when needed.

Consider taking out an annual policy if you intend to cruise more than once a year. It can be far cheaper than taking out individual policies.

The below video explains how I claimed travel insurance for a missed port.

Do Cruise Lines Check Your Travel Insurance?

Cruise lines are within their rights to ask to check that you have travel insurance before you travel.

Often when checking in online using the cruise line website or App, they will ask who you are insured with – and you are asked to fill in the form giving the travel insurer’s emergency telephone number.

Most Cruiselines insist that you have travel insurance – but its is on you to make sure you take it out and are adequately covered.

After the Covid pandemic, cruise lines would actually check your insurance policy in the terminal to make sure you had adequate Covid coverage!

If you could not prove you had cover, you would be denied boarding and many were.

Those days are now long gone, but taking out cruise insurance is as important as ever.

I spent many hours working on this step-by-step guide – so that you don’t have to! Why not check it out and see if you can save yourself time and money?

Cruise Travel Insurance – Why You Need it and How to Get It: (Step by Step Illustrated Guide)

Free Insiders Cruise Line Guide

Ever wondered how the mainstream cruise lines compare? Cruise lines won’t tell you this, but I will.

This FREE guide shows you everything you need to know to find your perfect cruise line.

Whenever I take a cruise I order a print of my trip. It uses the real satellite data from the cruise and is always a great conversation starter!

I'm building an impressive collection...

Code EMMACRUISES will get you 10% off