If you have ever considered taking a river cruise, you might wonder if you need to buy cruise-specific travel insurance.

Some people assume that that is only necessary for ocean cruises, but that isn’t always the case.

The answer depends on a few key things:

- Where are you cruising?

- What’s covered in your standard travel insurance policy?

- What could go wrong?

What’s the Difference Between Cruise Insurance and Regular Travel Insurance?

Standard Travel Insurance

Standard travel insurance usually covers the basics:

- Trip cancellation

- Medical emergencies

- Lost baggage

- Flight delays

Standard travel insurance is usually designed for land-based holidays rather than cruising.

Cruise-Specific Insurance

Would be likely to cover everything mentioned above PLUS specific things that can happen on a cruise:

- Missed Departures

- If you are late to the port because of flight or journey delays, and the ship leaves without you.

- Compensation For Missed Ports

- If the ship is not able to dock at a particular port of call, and the route is changed, the cruise line will not compensate you.

- Missed port cover may pay out a set amount for every port of call you miss.

- Emergency Medical Evacuation

- Ocean ships do have sick bays onboard to treat minor illness, but if it was something more major – like a stroke or heart issue you may be medically evacuated.

- This could mean the ship has to detour to the nearest port, or you could need to be evacuated by helicopter.

- River ships are unlikely to have sick bays. You would likely be sent off the ship to the nearest hospital on land.

- Cabin Confinement

- If you get sick and are forced to stay in your cabin – with Norovirus or Covid, for example – or if you have had an injury, you will receive a payout.

Do You Need Cruise Cover for a River Cruise?

You Might Not Need It If…

- You’re cruising within your home country (standard travel insurance might be enough).

- The standard travel policy you already have includes river cruises.

- Some do, but check the small print so that you know for sure.

You Need It If…

- Your river cruise goes through multiple countries.

- You want protection for missed departures, medical emergencies, or itinerary changes.

- The cruise line requires it.

- Many do, especially for longer or remote river routes.

Find out about the luxury river cruise I took with Uniworld below. We sailed around Venice and the Venetian lagoon. It was very different from the budget river cruises I had taken in the past.

What Can Go Wrong on a River Cruise That Insurance Covers?

- Medical Emergencies

- River ships don’t have onboard doctors like ocean cruises.

- You’d be taken to the nearest hospital, which could be expensive if you don’t have insurance to cover the costs.

- Missed Embarkation

- If you miss a flight or transfer and the ship sails without you, cruise insurance can help cover the costs of catching up with the ship.

- Low or High Water Levels

- This is always a risk when taking a river cruise.

- Sometimes, river cruises get cancelled or changed at the last minute due to high or low water levels.

- Insurance might cover additional costs – like flying to a different airport to join the ship.

- Lost or Stolen Luggage

- If your bags vanish between airports, trains, and embarkation, good insurance can help.

I took a Christmas markets cruise with Tui. River levels were dangerously high, and we had to fly to a different airport than originally intended.

Luckily for me, all flights and transfers are included in the cost of the holiday when you book a Tui river cruise from the UK – so it was Tui’s problem to sort out, not mine!

Find out all about that here:

How to Check If Your Insurance Covers River Cruises

Look for any exclusions in your travel policy – does it mention river cruising specifically?

Check for coverage on:

- Medical care and evacuation (especially in remote areas).

- Missed departures or delays.

- Cruise itinerary changes due to weather or water levels.

If in doubt, ask the insurance provider directly what is covered by the policy

If you book a river cruise, you may be offered travel insurance for that particular holiday. That should include cover for everything that could go wrong on a river cruise.

If you have an annual travel insurance policy, it is important to make sure you are covered for all eventualities mentioned above.

Before You Go

Find out more about cruise-specific travel insurance here:

Cruise Travel Insurance – Why You Need it and How to Get It: (Step by Step Illustrated Guide)

Find out what you get for your money when you book a river cruise here:

Why Are River Cruises EXPENSIVE? – The Truth Behind The Price

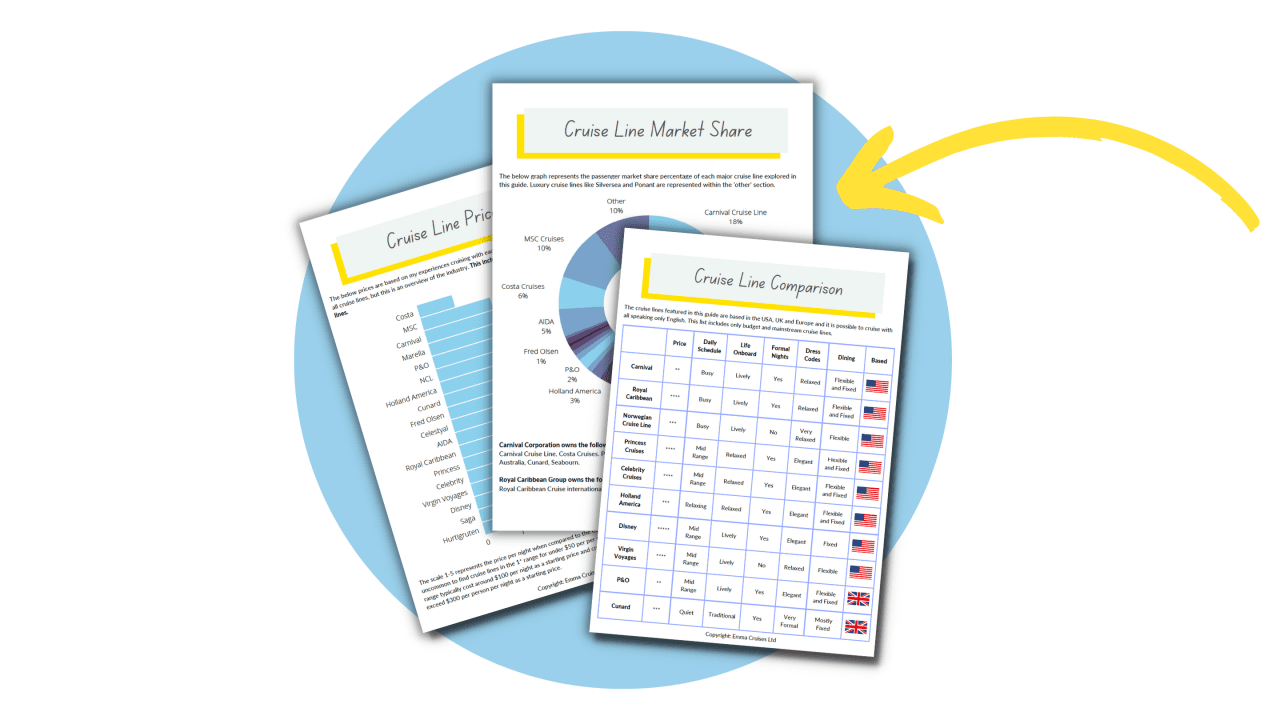

Free Insiders Cruise Line Guide

Ever wondered how the mainstream cruise lines compare? Cruise lines won’t tell you this, but I will.

This FREE guide shows you everything you need to know to find your perfect cruise line.

Whenever I take a cruise I order a print of my trip. It uses the real satellite data from the cruise and is always a great conversation starter!

I'm building an impressive collection...

Code EMMACRUISES will get you 10% off